So… you’ve been thinking about doing an estate plan, but every time you hear the words “will” or “trust,” your eyes glaze over, pictures of lawyers and complicated documents dance through your head, and your brain whispers, “Ugh…Not today, I can do that later.”

So… you’ve been thinking about doing an estate plan, but every time you hear the words “will” or “trust,” your eyes glaze over, pictures of lawyers and complicated documents dance through your head, and your brain whispers, “Ugh…Not today, I can do that later.”

You are not alone.

Most people put off estate planning because they assume it’s only for the wealthy, the elderly, or someone with a sprawling country estate and a yacht named Serenity Now. But here’s the truth: estate planning is for you—the everyday person with a bank account, maybe a house or a car, people you love, and a desire to not leave a mess behind if something unexpected happens.

And if you have no idea where to start, that is completely okay. Let’s break it down together. So without further ado let’s talk about where to start.

What the Heck is Estate Planning Anyway?

Estate planning is the process of making legal and practical arrangements for what happens to your stuff, your money, and – most importantly – the people you love if you become incapacitated or die.

It’s about making decisions ahead of time so that:

-Your loved ones aren’t left guessing (or fighting) about what you would have wanted.

-Your children or dependents are taken care of.

-Your money and property go to the people or causes you care about most (and people can find your money and property!).

-You avoid court dramas, unnecessary estate taxes, or legal delays (like probate court).

So at the end of the day Estate Planning isn’t some morbid process where you dwell on death. It is an act of love in the context of acknowledging our mortality. In the context of recognizing that accidents can happen. And it actually is an Act of Life – in that it allows us to seize the day and expand the opportunities we have in our life (by getting clear on who and what we have) and our legacy (by ensuring we do not leave a mess).

OK, I hear you asking the same question that brought you here. Where do I start?

Step 1: Take Stock of What You’ve Got

I’m going to hold your hand throughout the entire process with this blog, my intention is to make it as detailed as possible so that you know what’s expected as you start working with me.

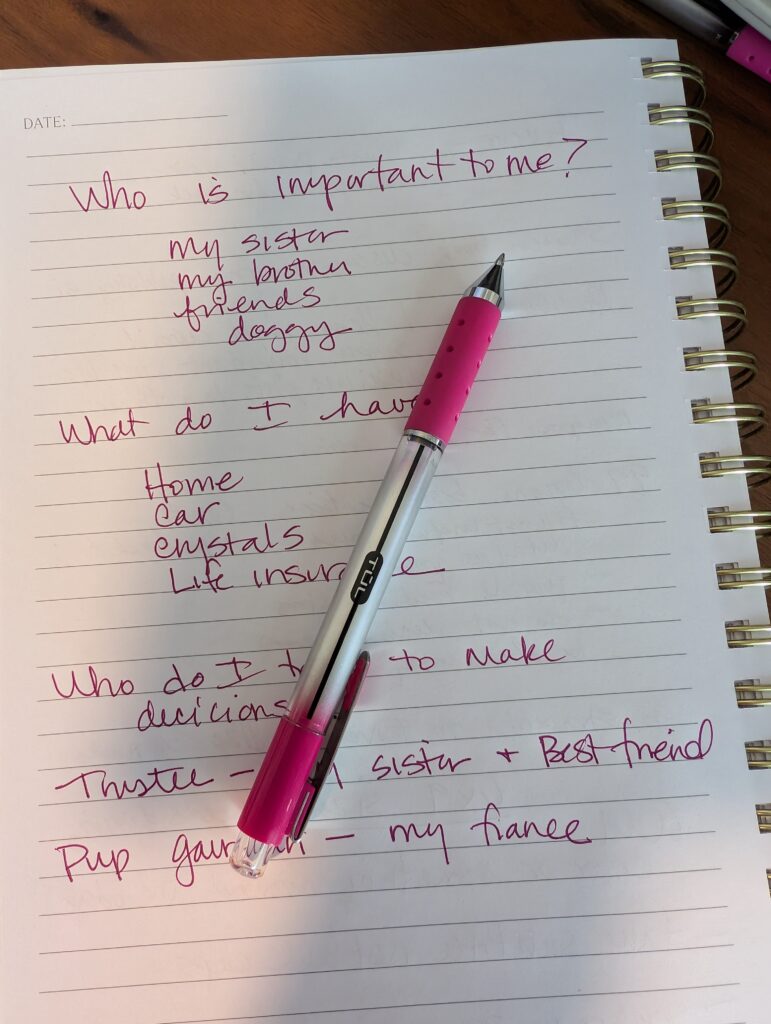

Let’s start super simple: just make a list. Go grab a paper and pen right now and come back.

Write your answers to these questions down:

Who you are doing this for (e.g. your spouse, your kids, your employees). This is your WHY. Who are all the people you care about and do not want to leave with regrets and hard feelings if you were suddenly gone. This might be 3-5 sentences or maybe you can do it all in 1 sentence. Either way the more you share with me when we meet the better I’ll be able to put together a plan that is most effective for you and your family.

Then write:

What you own (your assets). List out your checking/savings accounts, retirement plans, stocks, your house, your car, any life insurance, personal possessions, art, digital assets (yes, even your photos or crypto).

What you owe (your debts): mortgage, credit cards, loans.

This is your estate. And just seeing it written down can give you clarity and momentum.

Don’t worry about being perfect, this is just a snapshot. And your estate planning attorney is going to ask you for all of the above – so you are ahead of the game if you have it already in a list.

PS–if you completed this list book a call with me

Step 2: Choose Your People Wisely

Estate planning involves putting trusted people in charge of carrying out your wishes. These people need to be trustworthy, organized, and willing to act on your behalf. (Also contrary to what many people think, they do not need to be lawyers or financial professionals.)

Roles you will want to think about:

Successor Trustee and/or Executor: This is the person who will manage your estate after you die. They will do your final taxes (or hire someone to do them), they will pay the bills, set up trusts for your kids per your instructions, distribute your assets, and handle all the business of your death. Remember this is a job, not an honor – so pick someone you know can handle the role.

Long Term and Short Term Guardians: If you have minor kids, the long term guardian is the person you are trusting to raise your children. The short term guardians are the people you want on your emergency phone tree so in case of emergency your younglings have someone they trust to pick them up and take them home and tell them you are in the hospital. If you do not have named short term guardians your young children could end up in temporary foster care if something happens to you.

Healthcare Agent: This person makes medical decisions for you and advocates for your end of life decisions.

Power of Attorney: This person pays your bills and handles all the things on your behalf if you are incapacitated (but not dead). So who do you trust to make sure your life is not a giant mess when you wake up from being unconscious in the hospital?

A good rule of thumb is to have at least two backups for each person you name, per role, so that in case life happens you always have someone you trust ready to take on the responsibility. A good, experienced estate planning attorney will guide you through this process, however, they cannot pick these people for you. That is up to you.

So if you are still with me in this blog, pick up your pen and take a moment to write down the first people that come to mind for these roles we outlined above. If you don’t know right now, that is ok, you are thinking about it which puts you 10 steps ahead of where you were before. Bonus opportunity here, call the people you have written down and talk to them about this, experience the connection you can create having these conversations with the people you trust and care about.

Step 3: Create Your Core Documents

Once you’ve had your chat with an attorney, they will help you create the foundational legal documents that make up an estate plan. These often include:

Revocable Living Trust – Ensures you avoid probate and manages your assets during life and after death. Specifies who inherits what and sets up trusts for minors or special needs individuals.

Last Will and Testament – Your final testimony, just in case to the probate court.

Guardianship Appointments – specifying who will take care of your kids in case of death or emergency.

Durable Power of Attorney – Lets someone act on your behalf for financial matters if you are incapacitated.

Healthcare Directive / Living Will – Expresses your medical wishes (like life support decisions).

HIPAA Authorization – Allows your chosen healthcare agent to access medical records.

If that sounds like a lot that is because it is. But think of it as building a safety net that protects everyone you care about, and a good estate planning attorney will hold your hand through the process of creating these documents.

Step 4: Fund Your Plan

Creating a trust? Great. But if you do not actually put your assets into the trust by retitling accounts or property, it’s like building a treasure chest and forgetting to put the treasure inside.

DO NOT skip this step. And make sure your attorney will help you (not all estate planning attorneys do this – but my firm does). You want to make sure that your:

Real estate is titled properly

Bank and investment accounts are transferred correctly

Life insurance and retirement accounts have the right beneficiaries

Step 5: Communicate and Store Safely

Once everything is signed and finalized:

Let your successor trustee/executor and other agents know where to find your documents.

Give copies of relevant documents to your healthcare agent and power of attorney.

Store the originals in a secure, fireproof location (not a safe deposit box your family cannot access).

This is not a secret mission. The more your loved ones know, the easier it will be to carry out your wishes.

Lastly: Review Every Few Years (Or After Major Life Changes)

Your estate plan isn’t one-and-done. Life changes happen – marriage, divorce, babies, moves, or new laws can all affect your plan.

Try to review your plan every 3 years, or whenever something big changes in your life. My practice builds this 3 year review right into our process to ensure we are always keeping plans up to date.

Final Thoughts: Estate Planning Can Be a Healing Process, Not a Chore

Yes, it’s legal paperwork. Yes, it involves thinking about the what ifs. But creating an estate plan is ultimately about peace of mind.

It is how you take care of the people you love, even when you’re not there to say it out loud.

So if you’re standing at the starting line thinking, “I have no idea what I’m doing,”—take a breath. You’ve already taken the first step by reading this and making your list of people and things. Starting is the hardest part – now we just need to keep you going. You got this! In fact you have just done the homework I assign new potential clients so you are completely ready to book a call with me to continue the process of creating your estate plan.

All you have to do is click the link below for a short free discovery call to pick a date and time for your complimentary planning session where I’ll walk through the next steps with you.